Wind power industry surprised many observers with another record breaking year in 2015, chalking up 22% annual market growth and passing the 60 GW mark for the first time in a single year; and this after having broken the 50 GW mark for the first time in 2014.

Once again, the big story was China, installing an astonishing 30.8 GW against the backdrop of a slowing economy and nearly flat demand. Europe and the United States had surprisingly strong years; and Canada, Brazil, Mexico and other ‘new’ markets continued to develop.

Three big trends will continue to drive growth :

Climate: The positive outcome of the climate negotiations at the UNFCCC’s COP 21 in December where 186 countries adopted the long term targets for a 100% emissions free power sector by 2050 at the latest; and given the lack of any serious competition from any other emissions free power sources, it means a power sector supplied largely or completely by renewable energy, with wind and solar leading the pack.

The real test of the Paris Agreement, of course, will be in the implementation, and much could go wrong. However, it may have already played a role in the very aggressive RE growth targets contained in the recently released 13th Five-Year Plan in China.

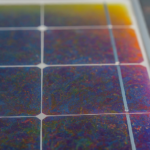

Cratering prices: It is clear that the costs of both wind and solar technology have fallen dramatically in recent years, and new and complex financing structures are creating the conditions for renewables to be competitive in an increasing number of markets. Of course, some of this is explained by the excellent wind resources in some of these locations, but the downward pressure on prices will continue, and not just in new markets. China is lowering its FIT for wind this year, and will do so again in 2018.

US Market Stability: The United States, as a pioneer in the global wind industry as well as having some of the best wind resources in the world, has had much lower prices than most of its OECD competitors for some time.

In addition to climate and competitiveness, energy security ranks high up on the list of drivers for the global market, as does the need to clean the air of the choking smog that is making more and more of the developing world’s major cities unhealthy places to live. The demand for clean, sustainable and indigenous power sources to fuel economic growth will continue to grow, especially in emerging economies across Africa, Asia and Latin America.

So what about the short term? While it’s very hard to turn the trends listed above into market forecasts for the next several years, we anticipate a period of sustained growth, although we do not expect the kind of spectacular growth we have seen in the last two years.

REGIONAL MARKET DEVELOPMENT

Asia will continue to dominate the period from 2016- 2020, capturing at least 50% of the global market, although its dominance may be tempered slightly towards the end of the decade. Europe will continue its steady pace towards its 2020 targets, although increasing policy uncertainty might mean some bumps in the road. With Mexico, Canada and the US all on a strong policy footing, North America should continue its strong growth for the rest of the decade.

Latin America will continue to be driven largely by Brazil, although there will be increasing contributions from a variety of markets, including a large new potential market in Argentina. Africa and the Middle East continue to diversify, although in the short term it will be dominated by South Africa, Egypt and Morocco, with Kenya and Ethiopia coming on strong. The Pacific region will return to substantial growth with a period of policy stability in Australia.