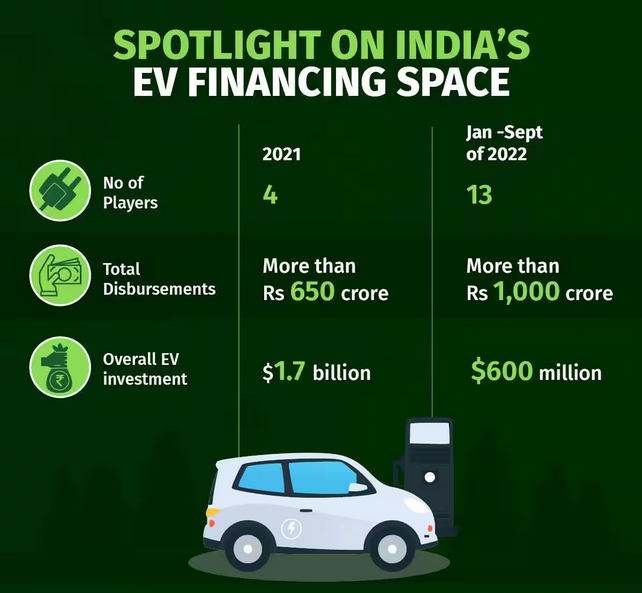

The Indian government has set an ambitious aim of 30% adoption of electric vehicles (EV) by 2030. The high initial prices of EVs, however, remain a substantial obstacle to mainstream adoption. To overcome this hurdle, “EV financing” is developing as a new business model and a crucial facilitator of EV adoption in India.

What is electric vehicle financing?

The provision of loans or other types of financial support to clients in order to enable the purchase of EVs is referred to as EV financing. These financing options can be provided by banks, non-banking financial firms (NBFCs), and other financial organizations.

Key Benefits

- One of the most major advantages of EV financing is that it allows consumers to spread out their payments for their EV, making it affordable.

- These financing options are designed to provide customers with flexible payment options that fit their budget and financial situation thus allowing them to switch to EVs without incurring a high upfront cost.

- Furthermore, EV loans are typically offered at lower interest rates than traditional vehicle loans, making them more accessible. These financing solutions also include attractive incentives like tax cuts and subsidies, which make them even more cost-effective.

The future of EV adoption in India is bright, thanks to the advent of novel financing structures and increased government and financial institution backing. As more individuals discover the benefits of EVs and the country strives toward a greener future, demand for EV finance is projected to climb even more.

The capacity of stakeholders to deliver customized solutions that respond to the individual demands of EV consumers while also aligning with the country’s long-term development goals will determine the viability of EV financing.

Reference- Economic Times, Moneycontrol Research, CNBC Network18, CEEW, Business Standard