Greenko Energy Holdings has emerged as the preferred buyer for Massachusetts-based NEC Energy Solutions in a deal potentially valued at around $300 million, said two people aware of the development.

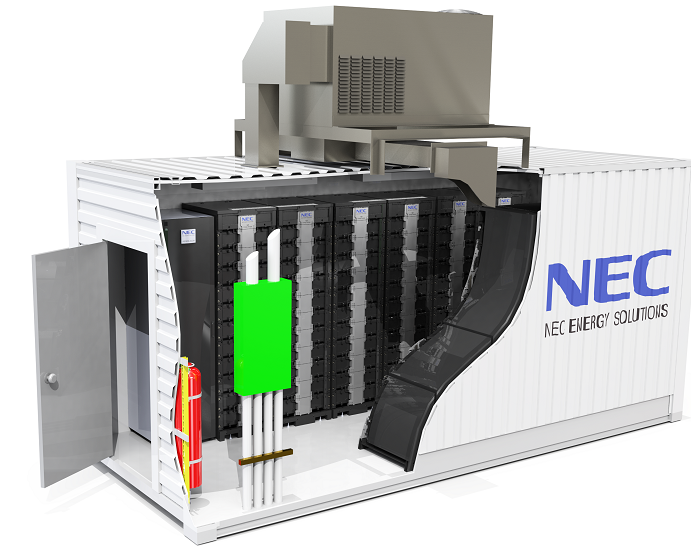

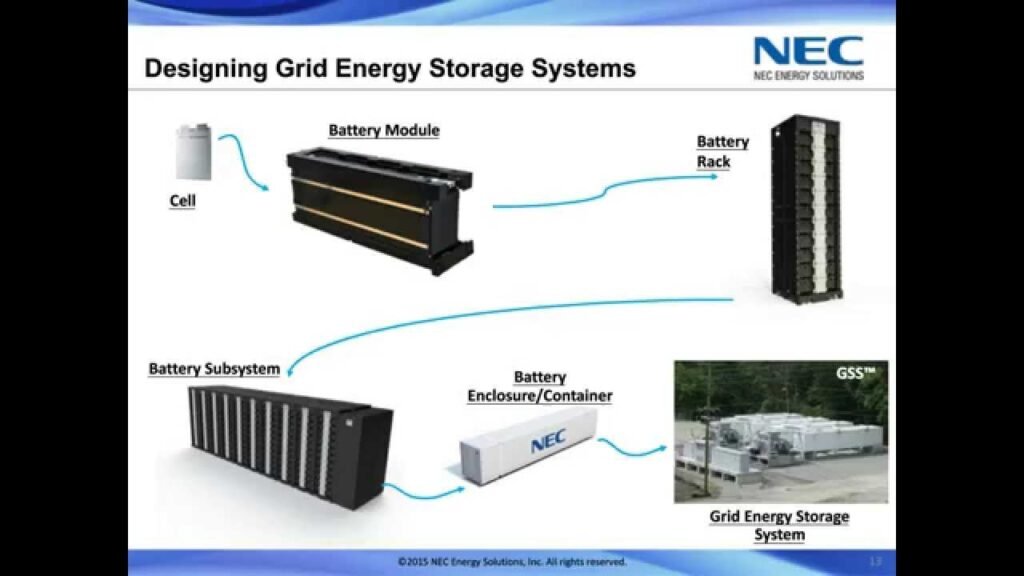

NEC Energy holds the intellectual property rights for megawatt-scale lithium-ion batteries. The development assumes significance and comes in the backdrop of India’ production-linked incentives (PLI) package worth up to around ₹2 trillion for 10 manufacturing sectors including, advanced chemistry cells (ACC) battery for the next five years.

This potential deal comes against the backdrop of Greenko investing in Silicon Valley-based Keracel, a maker of solid-state batteries, and the single-largest foreign clean energy investment in India so far of $980 million for a 17% stake in Greenko announced by Japan’s ORIX Corp on 11 September.

Sovereign funds GIC Holdings Pte. Ltd and ADIA-backed Greenko have pivoted towards battery storage and green hydrogen.

With India’s largest operational clean energy portfolio of 6.5 GW, Hyderabad-based Greenko plans to partner with state-run NTPC Ltd to develop ‘round-the-clock’ power supply.

This assumes significance given that solar and wind are intermittent sources of energy, with storage holding the key to providing on-demand electricity from these green energy projects.

With China dominating the lithium-ion cell manufacturing, India wants to avoid a repeat of events with solar equipment manufacturing where China leveraged its first-mover advantage to capture the market.

Reference- livemint, Economic Times