A recent report finds that India’s Production-Linked Incentive (PLI) scheme for solar manufacturing has played an important role in building the foundation for domestic photovoltaic (PV) production. However, the scheme continues to face major operational and policy hurdles that limit its full impact.

The PLI framework has been designed to link government support with measurable industrial output. As a result, long-term manufacturing capacity has begun to take shape. Since 2022, India’s solar manufacturing base has expanded rapidly. As of June 2025, operational capacity reached 120 GW for solar modules and 29.3 GW for solar cells.

Capacity additions after 2022 alone accounted for 82 GW of modules and 22.7 GW of cells, representing growth of 216% and 344%, respectively.

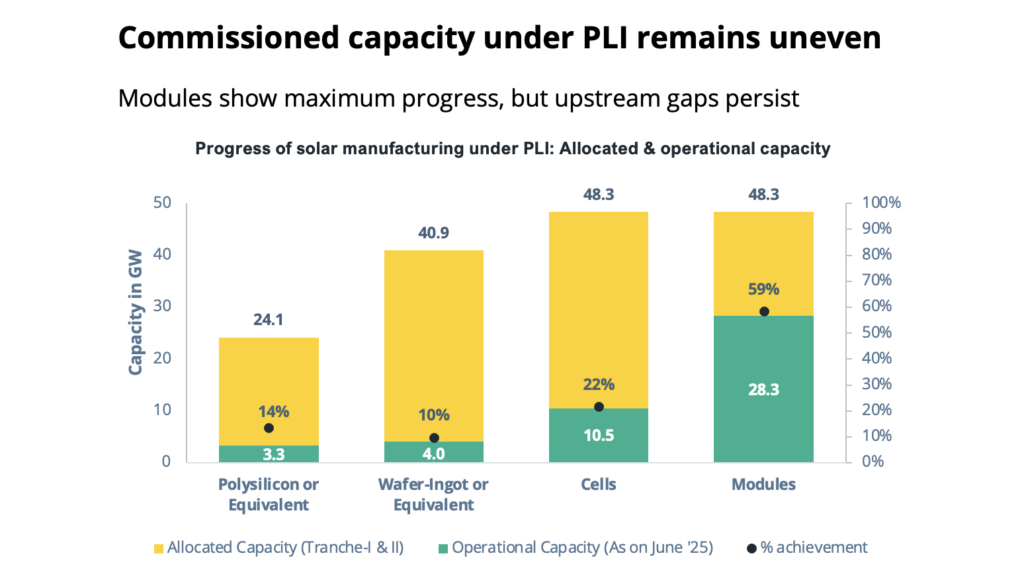

At the same time, upstream manufacturing remains weak. Whatever limited polysilicon and wafer capacity exists in India has emerged only through the PLI scheme. This highlights continued reliance on imports. About 36% of cell capacity and 24% of module capacity currently stem from PLI allocations.

However, several challenges persist. High capital costs for upstream integration have slowed progress. Incentives remain limited compared to total production costs. Inconsistent trade policies and frequent revisions to the Approved List of Models and Manufacturers (ALMM) have added uncertainty. Meanwhile, unrestricted imports of polysilicon and wafers have created policy asymmetry for domestic firms.

India’s dependence on imported machinery and foreign technical expertise has also delayed capacity ramp-ups. Meanwhile, global price volatility—especially for polysilicon and wafers—continues to expose manufacturers to cost risks, largely due to China’s dominance in upstream supply.

Implementation delays have further reduced the scheme’s economic impact. By June 2025, developers commissioned only 31 GW of the targeted 65 GW module capacity. The sector attracted ₹48,120 crore in investments and created 38,500 direct jobs, falling well short of official targets.

The financial risks are also significant. According to report, solar PLI awardees face cumulative exposure of up to ₹41,834 crore, due to penalties, lost incentives, and unrealized revenue.

The report concludes that the scheme needs re-calibration, not just timeline extensions. Going forward, layered incentives, low-cost financing, upstream support, and long-term policy certainty will be critical—especially as emerging 50% US tariffs on Indian solar exports add fresh pressure.

Reference- Report by JMK Research and IEEFA