Commercial and industrial (C&I) consumers are emerging as a key driver of renewable energy deployment. Corporates are shifting procurement strategies to lock in stable tariffs and meet decarbonisation goals.

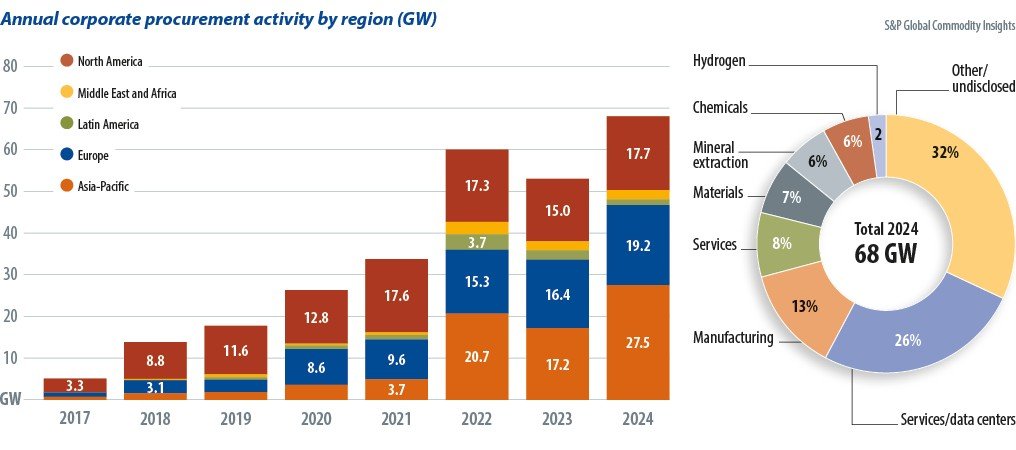

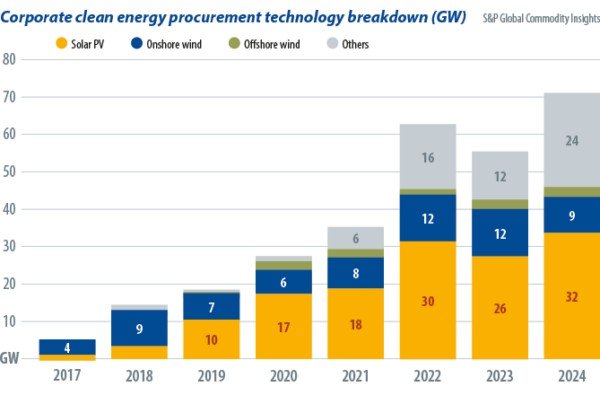

Corporate power purchase agreements (PPAs) continue to expand. Global corporate clean energy procurement hit a record 68 GW in 2024, up 29 % year-on-year, driven by data centers and technology firms, according to S&P Global Commodity Insights. Solar remains the preferred technology due to faster permitting and construction timelines.

Meanwhile, renegotiations are increasing. Buyers are seeking flexible contract structures, volume discounts and escalation clauses as market volatility and interest rates rise. In response, utilities are offering hybrid procurement models and bundled green tariffs to retain industrial customers.

Third-party open access and captive models are competing for dominance. Open-access renewable power can undercut grid tariffs by 20-30 %, accelerating corporate switching. Captive projects remain attractive due to lower charges and regulatory certainty in several Indian states. Analysts expect open access to account for about 25 % of C&I consumption by 2028 if surcharges are rationalized.

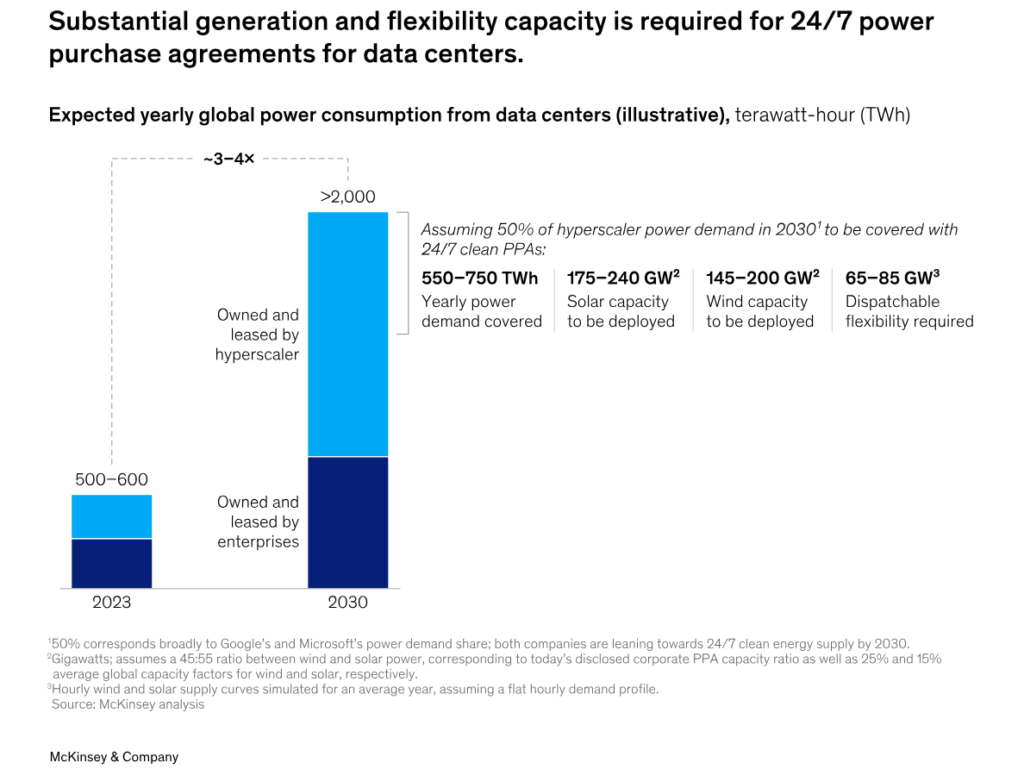

Demand for round-the-clock (RTC) power is rising. Hyperscalers and manufacturers want time-matched clean power instead of annual offsets. Technology firms are committing to 24/7 clean power procurement, pushing developers toward hybrid solar-wind-storage projects.

State-level regulation remains the biggest variable. Charges for transmission, wheeling and cross-subsidy vary widely, creating fragmented market conditions. Some states are easing approvals and promoting green open access, while others impose additional surcharges that slow project development.

The outlook is positive but uneven. Rising electricity demand from digitization, electrification and industrial growth will sustain C&I renewable adoption. Yet financing costs, grid constraints and policy uncertainty could temper growth in the near term.

For developers and investors, the C&I segment offers predictable demand and long-term contracts. For corporate, renewable procurement is no longer just a sustainability decision. It is a strategic hedge against volatile power markets.

Reference- PV Magazine India, Knowledge Ridge, McKinsey & Company