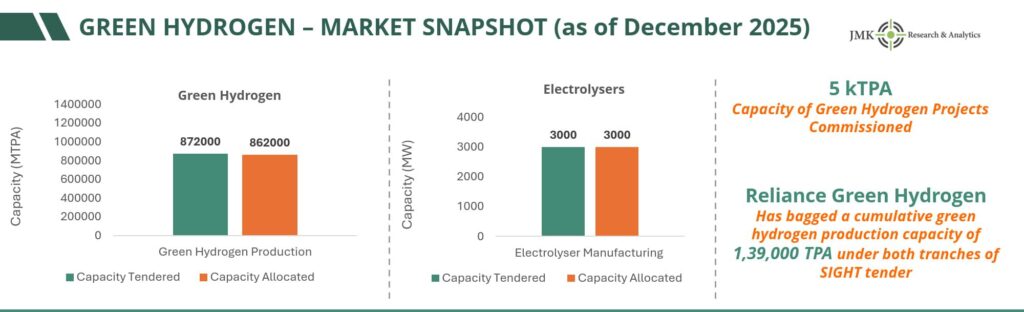

India’s green hydrogen market continued to expand during the last quarter of 2025. Project announcements increased across sectors such as refining, fertilizers, steel, and mobility. However, actual commissioning remains limited, according to JMK Research’s Green Hydrogen India Market Update (Q4 2025).

By the end of 2025, India had announced more than 12 million tonnes per annum (MTPA) of green hydrogen and green ammonia capacity. Most projects remain in the early development stage. Only pilot-scale facilities are currently operational. This gap reflects high costs, infrastructure constraints, and demand uncertainty.

Electrolyser manufacturing showed faster progress. Domestic electrolyser capacity crossed 25 GW per year, supported by incentives under the National Green Hydrogen Mission. Several Indian manufacturers scaled up alkaline and PEM electrolyser lines. Yet, the supply chain still depends on imported components. This dependence raises costs and slows execution.

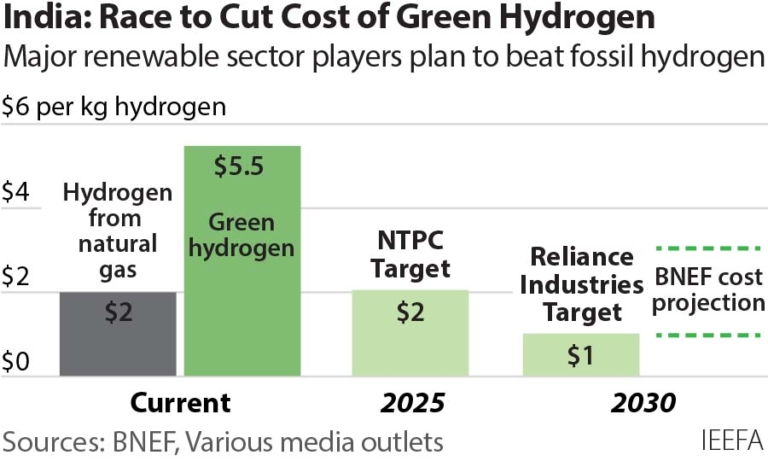

Green hydrogen production costs in India remained high in 2025. Average costs ranged between ₹350–₹450 per kg, depending on renewable power prices and electrolyser efficiency. Costs will likely fall after 2027 as renewable power tariffs decline and production scale improves. The International Energy Agency (IEA) and IEEFA have also highlighted similar cost trends.

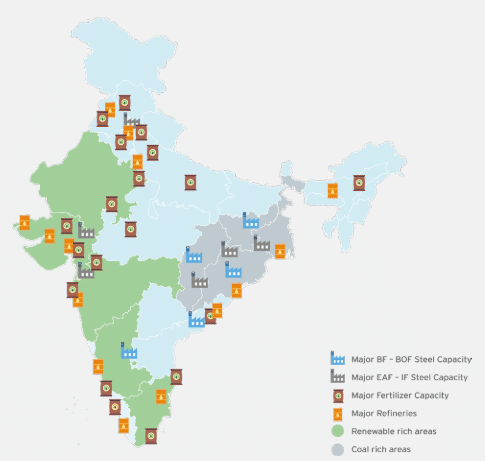

Demand visibility remains uneven. Refiners and fertilizer producers show early adoption interest. Steel and heavy transport players continue to rely on pilots. Long-term offtake contracts are limited. As a result, project financing remains cautious. Some capacity has been delayed.

Export opportunities are shaping future plans. India is positioning itself as a supplier of green ammonia to Europe and East Asia. Coastal projects in Gujarat and Odisha are gaining attention. However, port infrastructure and global certification standards remain unresolved.

Overall, the report notes that policy clarity will determine market momentum. In particular, the sector needs support for off-take mandates, storage, pipelines, and financing instruments. Without coordinated execution, capacity targets may slip. However, with timely and aligned action, India could emerge as a competitive green hydrogen hub by 2030.

Reference- JMK Research (Green Hydrogen India Market Update Q4 2025); IEA; IEEFA.

Comments are closed, but trackbacks and pingbacks are open.