The cultivated meat industry has promise. It aims to cut emissions and reduce land use. But it is losing steam. Growth is slow, and barriers are mounting. Demand exists. Yet progress stalls.

The global lab-grown meat market was about USD 0.36 billion in 2024. Analysts expect it to grow to USD 20.6 billion by 2035 at a 44.5 % CAGR. . Other forecasts vary, but growth is robust overall. .

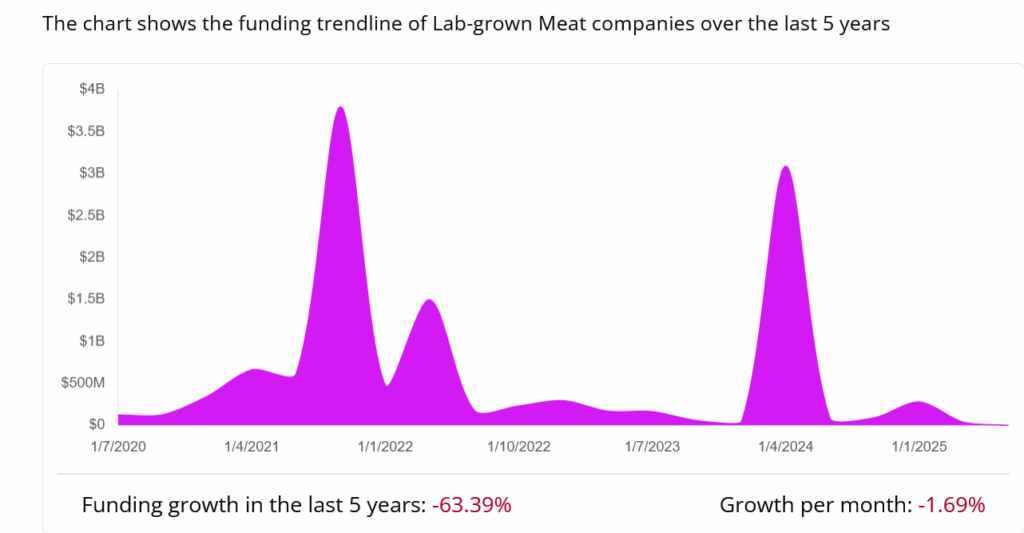

A Just Food analysis finds most cultured meat companies struggle. Regulatory approval in North America and Europe remains a bottleneck. . Firms cannot scale without clear rules. At the same time, scaling is needed to stay solvent. It creates a loop that many startups cannot break. Investment influx has slowed from peaks of earlier years. Funding dipped sharply in 2023 and continues to face headwinds. Experts warn slow financing will limit production scale and slow cost declines. .

Despite slower finance, innovation persists. AI and machine learning are improving cell culture conditions. They cut costs by up to 40 % and speed production. . Serum-free growth media is increasingly used, reducing reliance on animal inputs. .

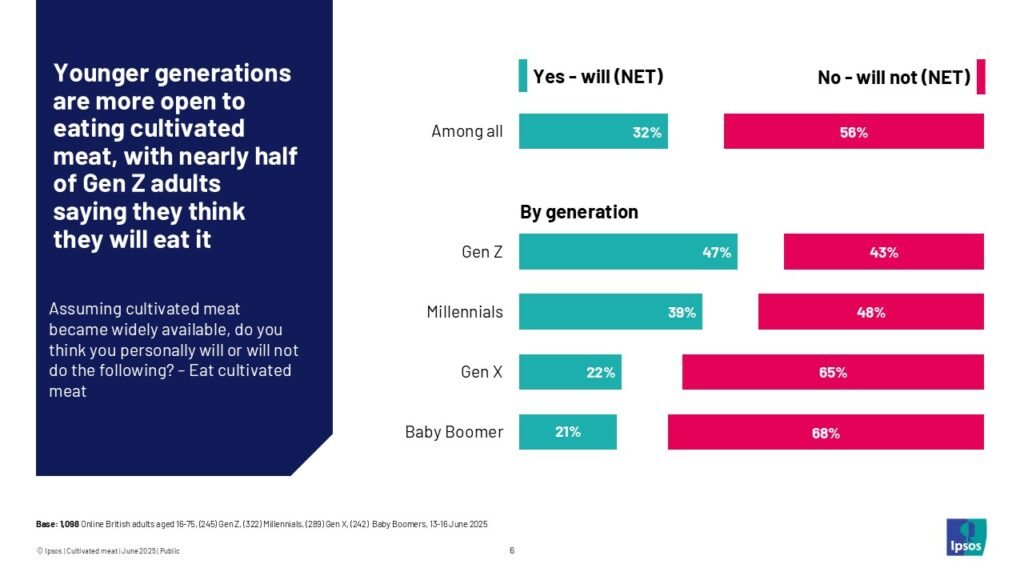

Consumers show interest. Surveys indicate 42 % of urban Americans are willing to try cultivated meat. . Yet legal challenges and bans are rising. Some U.S. states restrict sale or production. . In the EU, lawmakers are pushing limits on how cultured meat can be labeled. .

Advocates argue that lab-grown meat could cut land use and emissions dramatically. Some estimates suggest up to 96 % less water and greenhouse gas output than conventional meat. . But scaling remains distant. Policy clarity and investment will decide the future. Without them, cultured meat may lag behind its potential to reshape food systems.

Reference- Futurism, The Verge, WIRED, MetaTech Insights