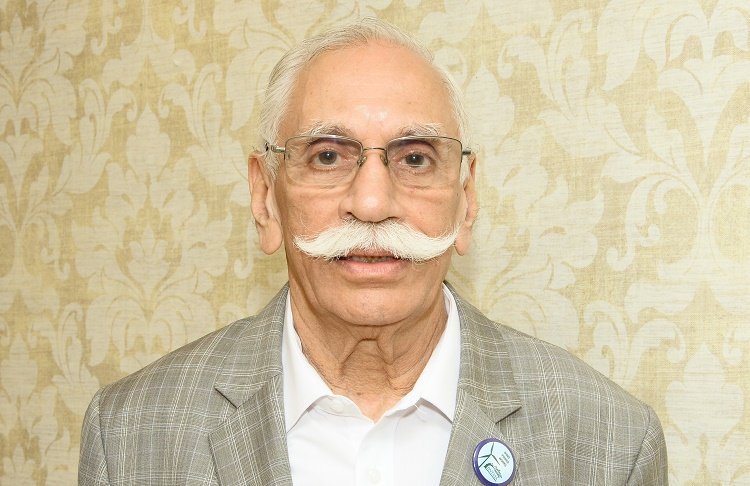

The Secretary General for Indian Wind Turbine Manufacturers Association, D.V. Giri discusses the latest trends in Wind Energy sector with Clean Future and further explains in detail the viability of this sector in India

What are the current trends prevailing in the wind energy sector?

The country is going through a period of rapid change and with government’s commitment towards renewable sector. Thus new winds of change that are shaping the Wind Sector in India that are primarily driven by key trends such as:

Competitive Bidding: There is a paradigm shift from Feed in Tariff to Competitive Bidding. The first bid of SECI is at Rs.3.46 per unit and the second bid is in process. Many states are also opting for competitive bidding as a transparent process. What is important is sustainable development, keeping in mind the target of 60 GW by 2022 and mainstream renewables by 2030.

Wind power investment is by the private sector and tariff determination will depend on capex, interest and PLF and to have a meaningful IRR. As they say, “Water will find its own level”. We are sure that this mature industry will move forward. Another interesting area is the vast opportunity in exports which can climb up to 2000 MW in the next 2 – 3 years. There are certain challenges which can be turned into great opportunities and discussions are on with the appropriate Government agencies.

Scheduling & Forecasting: Scheduling & Forecasting will play a major role for Wind to be treated as firm power coupled with technologies for storage considering the higher penetration of RE source.

What kind of financial returns can an investor expect from wind farms?

As mentioned earlier, projects are invested by the private sector supported by investments from private equities and other funding agencies. Irrespective of the changes that can take place in any of the parameters, an investor would look at an IRR of 16 to 18%. Marginal adjustments can take place in short term when policy shift takes place but sustainable advancement can take place only on fair returns.

How important and financially viable is Re-Powering for the Indian wind energy sector?

More than financial viability, policy on repowering is much more critical. Repowering of old turbines with new turbines with marginal increase in capacity has no meaning. A 250 KW turbine in Tamil Nadu covering a land area of 5 acres should accommodate 2 MW turbine or more with a multiplier effect of 8 for repowering to be really successful. This, of course, would require grid augmentation in that area.

Furthermore, a friendly policy for original owners of the land to give up their land and old machines for repowering say, possible model of cooperative farming which will hold large parcel of contiguous land for 100 or 200 MW wind farm.

It would be worthwhile to look at export of dismantled turbines after refurbishment to SAARC or African countries where wind energy programmes are in early stages. Intercropping is a good possibility subject to permissions from the existing owners and look into the “wake” effect.

What kind of wind turbine changes are we expecting in the coming years?

This mature technology and to work in low and medium wind regime will see larger turbines with higher hub heights and larger rotors. While the technology is available, we need to look at infrastructure by roads to carry over dimensional cargo with multi axle trailers and material handling equipment to handle the project work. Grid network and storage will hold the key for the changes that will happen in new and larger turbines.

In your experience, which direction are tariffs heading in near future?

It is too early to predict wind tariffs as at present. With no input cost, Government’s ambitious plan to bring in volumes, possible incentivized programme for localization will certainly help competitiveness in the levelised cost of energy delivered and have a sustainable model instead of looking only at driving down cost.