Adani Green Energy has tied up with around 10 international banks to diversify construction finance portfolio for its ongoing and future projects.

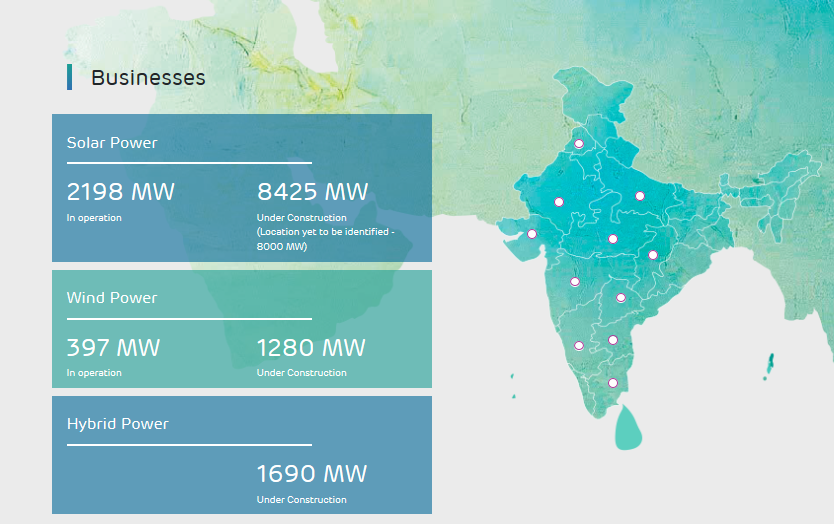

The company — which has a portfolio of 14 GW of operating, in- construction and awarded wind and solar parks — is aiming to commission renewable capacity of 25 GW by 2025.

They have a very large construction pipeline. Typically they would take construction financing from Indian banks and once thee projects are operational then they refinance the portfolio by raising international bond funding.

However since the magnitude of funds required is way to high so in addition to the Indian banks they have decided to approach about 10 odd international banks who are going to work with them for construction greenfield funding.

This move is a step towards diversifying its construction finance portfolio as well so that all projects are fully funded at the time of execution.

It is going to be a revolving construction facility so as soon as the projects are commissioned they will be taken out from the international bond market and the facility will be made available for the next wave of assets coming on.

Adani Green Energy has posted a consolidated net profit of Rs 21.75 crore for June quarter mainly on the back of higher revenues.

Reference- Economic Times, livemint, Mercom India, The Hindu Businessline