The winners of India’s PLI scheme have mostly included supply chain partners and service providers from China. Major players in the renewable energy industry, including Reliance New Energy Solar, Tata Power, ReNew Solar, Avaada Electro, and Waaree Energies, have identified Chinese vendors as their primary suppliers.

Indosol (Shridi Sai), a recipient of the first phase of solar PLI, has identified 94 vendors, with 65 of them being Chinese. Reliance New Energy, on the other hand, has listed all 20 of its foreign vendors as being from China. Adani Mundra, the solar manufacturing division of Adani Group, has not yet provided the government with any names.

Tata Power Solar, which won the second tranche of the PLI scheme, has identified seven suppliers or supply chain partners. Among these, four are from China, two are from Germany, and one is from Singapore.

All 17 supply chain partners for Waaree Energies’ PLI project in India are Chinese, making it one of the country’s oldest solar equipment manufacturers. VSL Solar, AMPIN Solar, and Grew Energy rely on Chinese vendors for over 90% of their supplies, along with other companies.

The companies have provided a list to the Ministry of New and Renewable Energy in order to help foreign experts from organizations obtain visas because India’s capacity for manufacturing solar modules is still in its early stages, the supply chain required to establish it is predominantly controlled by China.

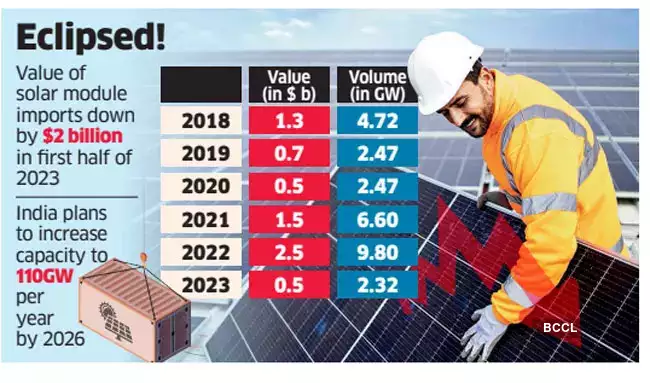

The PLI scheme for solar power aims to enhance the domestic production of solar equipment and decrease reliance on imports as today approximately 70% of India’s solar power capacity relies on solar equipment manufactured in China.

Seeing the above state of affairs, the government in 2021 announced PLI schemes for 14 sectors such as telecommunication, white goods, textiles, manufacturing of medical devices, automobiles, speciality steel, food products, high-efficiency solar PV modules, advanced chemistry cell battery, drones, and pharma, with an outlay of ₹1.97 lakh crore.

The schemes aim to attract investments in key sectors and cutting-edge technology; ensure efficiency, bring economies of size and scale in the manufacturing sector and make Indian companies and manufacturers globally competitive.

Reference- Business Standard, PV Magazine, mint, Mercom India Research, Economic Times