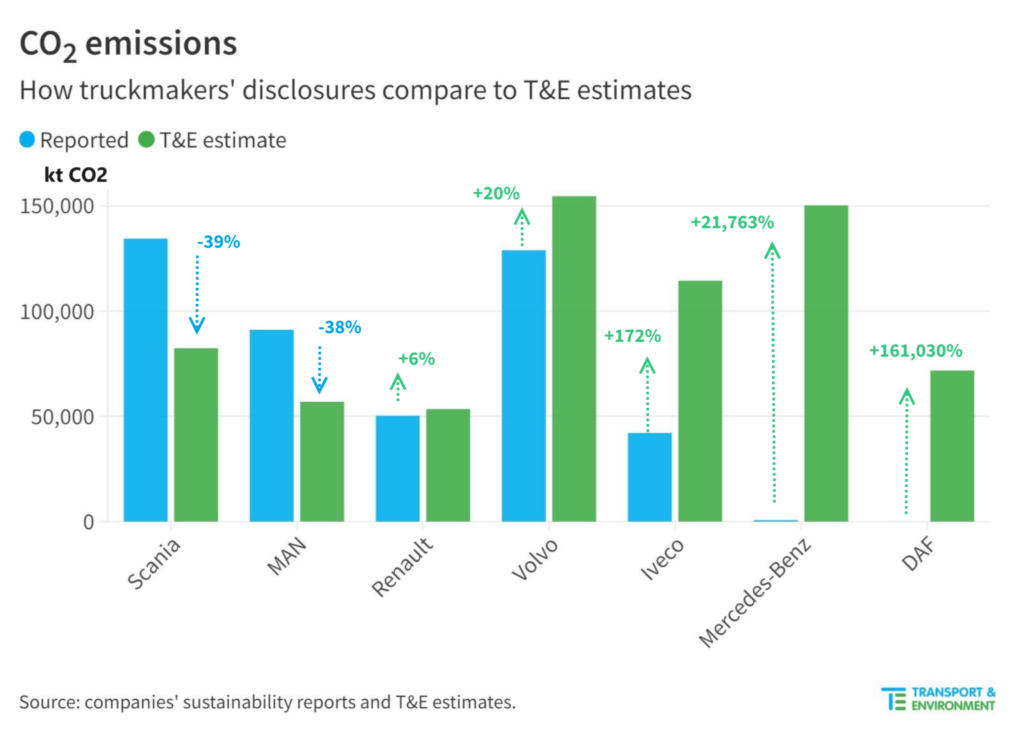

A recent study by Transport & Environment (T&E) exposes a significant discrepancy between the environmental impact European truckmakers report to investors and their true footprint. The research, focusing on industry leaders Scania, MAN, Renault, Volvo, Mercedes-Benz, DAF, and Iveco, reveals a shocking truth: emissions are 50% higher than what these companies disclose.

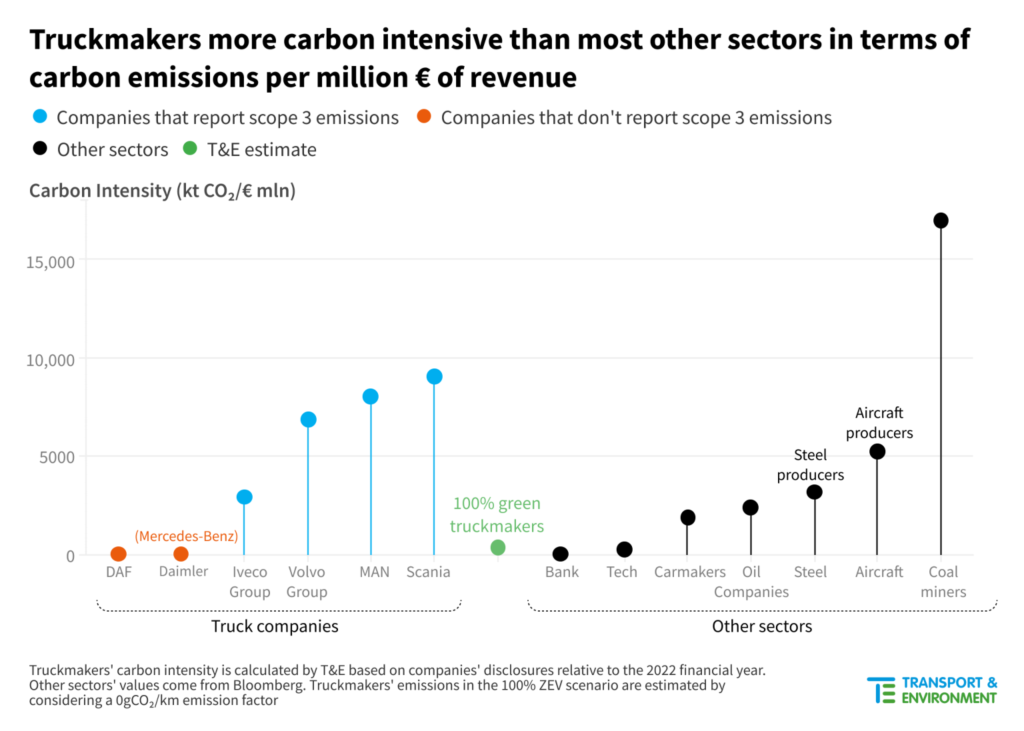

This revelation carries serious consequences for investors seeking environmentally responsible options. The report highlights that truckmakers currently boast a higher carbon intensity (emissions per euro of revenue) than even oil and steel producers. In fact, only coal mining surpasses them in terms of climate impact within major industries.

Incomplete Reporting Creates a Misleading Picture

The crux of the issue lies in a previously overlooked category of emissions – Scope 3. Unlike reported emissions (Scope 1 & 2), Scope 3 encompasses a company’s indirect emissions, primarily arising from the use of their products. In the case of truckmakers, this translates to the vast amount of fuel burned by their vehicles throughout their lifespans. A single truck can consume a staggering 450,000 liters of fuel, accounting for a whopping 99.8% of a manufacturer’s total carbon footprint.

Alarmingly, the T&E study found that several companies entirely neglect to report Scope 3 emissions. Mercedes-Benz and DAF are the most egregious offenders, disclosing a mere 0.1% to 0.2% of their actual impact. While IVECO reports a third, Renault and Volvo also significantly underestimate their emissions. Only MAN and Scania provide a more accurate picture.

ESG Ratings Fail to Capture the Full Story

This lack of transparency extends to Environmental, Social, and Governance (ESG) ratings, a tool used by investors to assess a company’s sustainability practices. The T&E report criticizes the inadequacy of current ESG metrics, highlighting how most agencies award truckmakers sustainability scores comparable to renewable energy companies. For instance, Mercedes-Benz boasts a better environmental score on Bloomberg’s rating than Siemens Gamesa, a leading wind turbine manufacturer. This discrepancy largely stems from the fact that less than 3% of Bloomberg’s score considers Scope 3 emissions.

A Call for Transparency and Electrification

The good news is that change is on the horizon. The European Union recently implemented regulations mandating truckmakers to progressively increase sales of zero-emission vehicles. This move could reduce emissions by 29% by 2030.

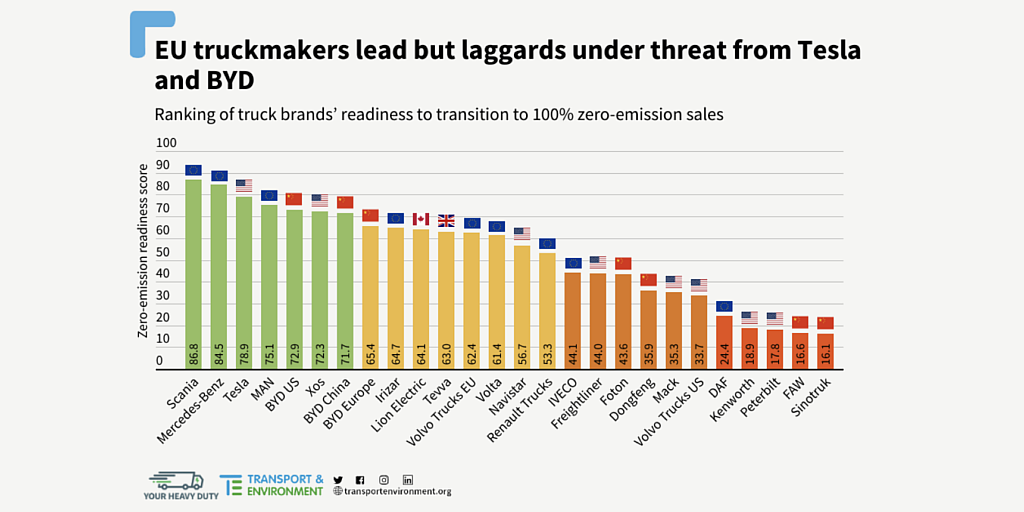

However, a more significant shift towards electric trucks is crucial to achieve substantial decarbonization. Currently, a mere 3% of heavy-duty vehicles sold are electric, a stark contrast to the 15% penetration rate for electric cars. The success of companies like Tesla and BYD in the electric truck space demonstrates the viability of this path.

In conclusion, this study sheds light on a concerning trend of under-reported emissions within the European truck manufacturing industry. By demanding comprehensive Scope 3 reporting and accelerating the transition to zero-emission vehicles, stakeholders can push for a cleaner and more sustainable transportation sector.

Reference- Transport & Environment (T&E), “Truck manufacturers a more carbon intensive investment than oil, steel or cars – study” (2024), Greenhouse Gas Protocol, “Corporate Accounting and Reporting Standard” (2023), Clean Technica