India’s renewable energy market is witnessing a surge in activity, with a growing number of companies seeking investment. This trend, however, is creating a buyer’s market as companies vie for investor attention.

Big Names Seeking Exits:

Leading companies like Siemens and Shell are exploring divestments. Siemens is looking to sell its wind turbine unit, while Shell, after acquiring Sprng Energy in 2022, is now seeking new investors. Private equity firms like EQT and Temasek are also looking to exit their 4GW O2 Power platform. This trend extends to other companies like Macquarie, which is exploring the sale of its Stride and Vibrant Energy platforms.

Investor Caution Amidst Opportunity:

Despite the rising interest in green energy, not all companies will secure investment (problem). Experts cite oversupply and valuation discrepancies as potential hurdles. However, successful transactions could attract new investors, particularly those interested in commercial and industrial (C&I) assets.

Robust Demand, Stringent Criteria:

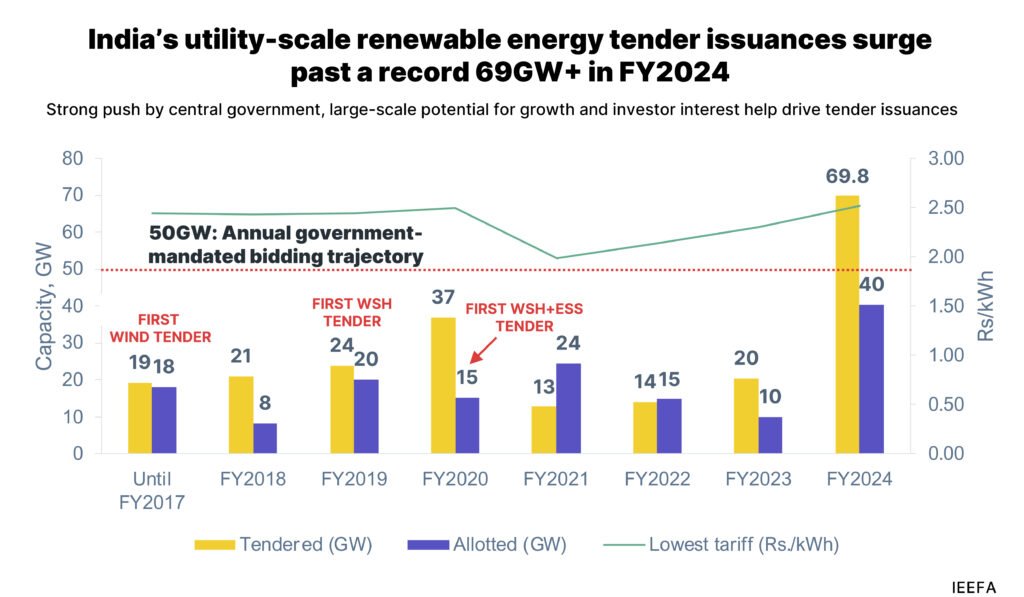

A recent report by IEEFA and JMK Research & Analytics highlights the sector’s strength. India witnessed tenders for over 69 GW of renewable energy projects in FY24, exceeding government targets of 50 GW (evidence). This indicates strong investor interest, with solar and wind projects dominating the market.

Success Hinges on Strong Fundamentals:

Investors will prioritize projects with robust financials, clear regulatory pathways, and experienced management. Market sentiment and the performance of existing players will also influence investor decisions.

In conclusion, while India’s renewable energy sector presents significant investment potential, fundraising success will depend on companies demonstrating these critical factors.

Reference- liveMint, Mercom India, Institute for Energy Economics and Financial Analysis (IEEFA), JMK Research & Analytics