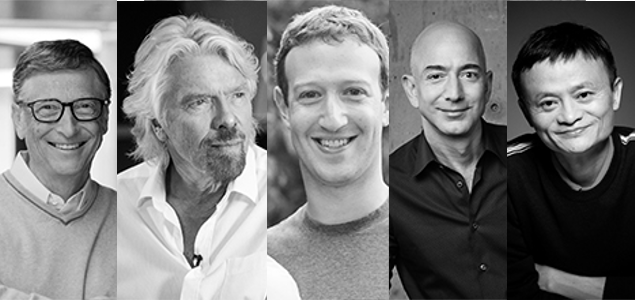

Bill Gates, Jeff Bezos, Mark Zuckerberg, Reid Hoffman, Jack Ma, and David Rubenstein all have combined their considerable financial resources to create Breakthrough Energy Ventures.

Bill Gates, Jeff Bezos, Mark Zuckerberg, Reid Hoffman, Jack Ma, and David Rubenstein all have combined their considerable financial resources to create Breakthrough Energy Ventures.

Formed in 2016 with an initial capitalization of $1 billion, BEV says its investments will be “patient capital,” which means a return on its investments may not happen for 20 years or more, giving the scientists and engineers it supports the time they need to develop disruptive technologies that could change the world.

BEV announced its first two investments will be in energy storage companies — Form Energy and Quidnet Energy. Both say they are working on radical new energy storage technologies that could capture excess renewable energy for later use at very low cost.

Inexpensive storage will be the key that unlocks the full potential of renewable energy technology.

Form Energy is using sulfur, which is abundant and cheap, instead of lithium, which is scarce and expensive. They don’t even describe what they are making as a battery they call it a bi-directional power plant that can send energy out and also take it in and store it when needed. It’s a battery purposely built for the renewable grid.

On the other hand Quidnet Energy says it “operates at the nexus of energy and water to provide cost-effective, grid-scale electricity storage. This enables predictable delivery of power from intermittent sources and large-scale deployment of renewable energy.

Grid decarbonization today is at an impasse. The intermittency of renewable generators are causing ever larger power swings on the grid, leading to blackouts and forced curtailments. Without a cost-effective electricity storage solution to buffer those swings and shift renewable power to when the grids needs it, renewables will be nothing but a niche source of clean power.

Reference- BEV website, Quidnet Energy website, Cleantechnica, Form Energy website