More than 80% of India’s local demand for solar modules have been met through imports from other Asian countries such as China, Vietnam and Malaysia. At present, the cumulative solar cell and module manufacturing capacities of India are about 4 GW and 16 GW respectively.

Additionally, the manufacturing capacity for upstream stages of polysilicon, ingot and wafer is absent in the current Indian landscape, on account of primarily, high production costs.

However, the Indian government, in a renewed effort to reduce import dependence and scale up domestic PV manufacturing capabilities, has introduced Basic Customs Duty (BCD) on imports and Production-linked Incentive (PLI) scheme for new manufacturing facilities.

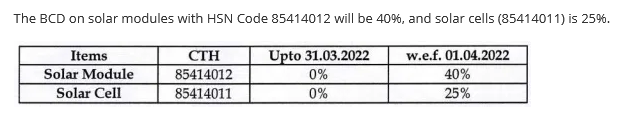

Effective from April-2022, the BCD on solar modules will be 40%, and on solar cells, it will be 25%.

Aligned with India’s vision of becoming ‘Atmanirbhar’ and to catalyse India’s manufacturing capabilities, as part of PLI scheme, the government has committed Rs. 4,500 crores for ‘High-Efficiency Solar PV Modules’ which will be implemented by Ministry of New & Renewable Energy (MNRE).

Under the PLI Scheme, 10 GW capacity of integrated solar PV manufacturing plants (from manufacturing of wafer-ingot to high-efficiency modules) will be set up by Q4 of 2022-23 with a direct investment of ~Rs. 14,000 crores.

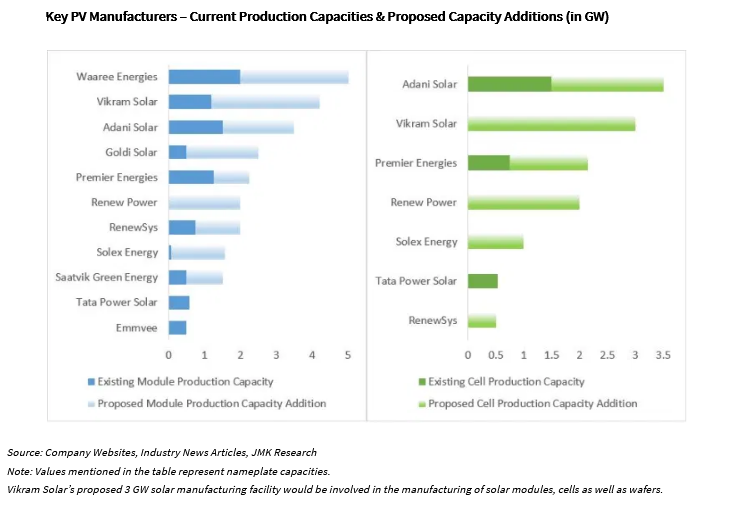

Several PV manufacturers, in this backdrop have committed to expand their existing manufacturing capabilities.

Module manufacturers with 1 GW+ capacity (i.e. Waaree Energies, Adani Solar, Premier Energies and Vikram Solar) have proposed (in cumulative terms) module manufacturing capacity addition of 9 GW and cell manufacturing capacity addition of 6.4 GW.

If all goes according to plan 13.75 GW of new module and 6.9 GW of new cell production capacity is likely to be added in India in next 18 months.

This article is based on “JMK Research” newsletter; edited by Clean-Future Team