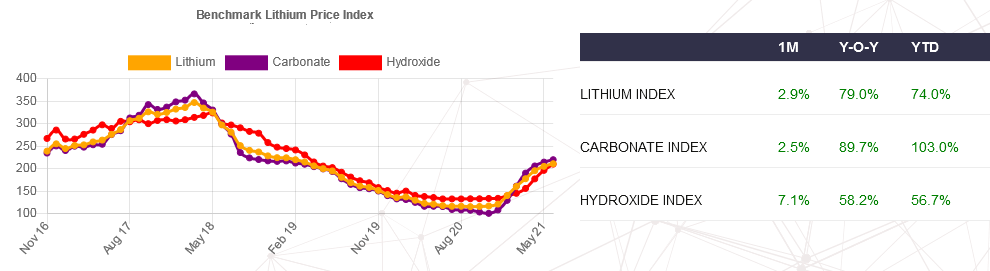

Prices of battery materials have skyrocketed this year as electric vehicle (EV) demand jumps. Prices of lithium carbonate, used in cathodes, have doubled year-to-date, according to research firm Benchmark Mineral Intelligence.

Prices for cobalt hydroxide, which boosts energy density and battery life, have risen more than 40%.

Benchmark Mineral Intelligence expects most battery raw-material markets to remain tight this decade. And it forecasts that the lithium market will fall into deficit in 2022. Most supply-chain contracts are “cost pass through,” which means EV manufacturers have to bear cost increases.

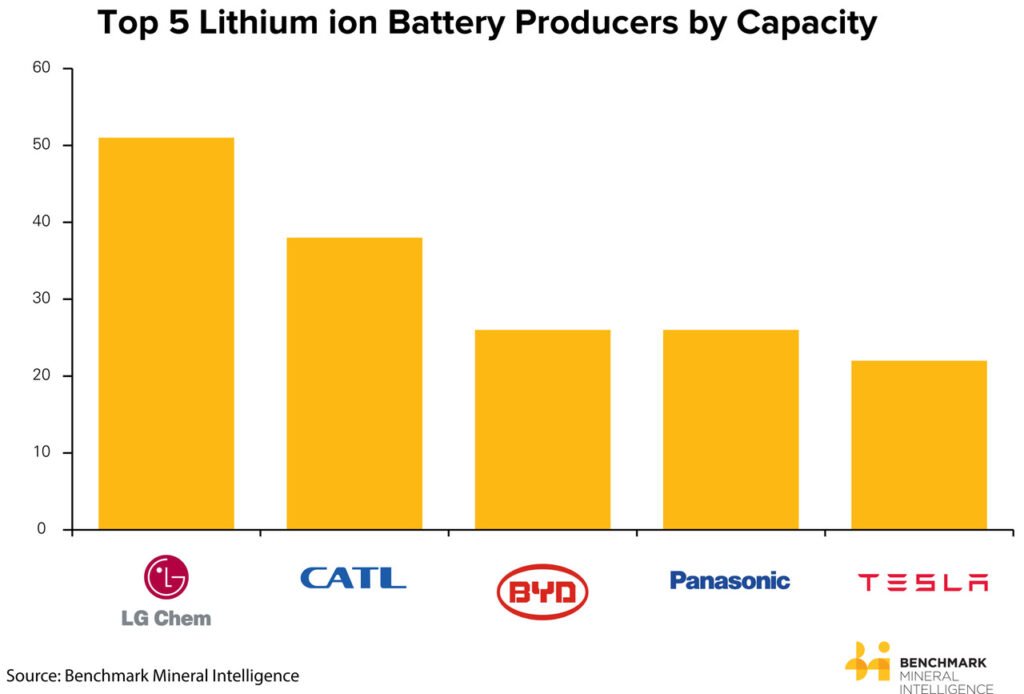

Leading firms such as China’s Contemporary Amperex Technology and Korea’s LG Energy Solution may have better bargaining power with auto makers. In the first five months of the year they were neck-and-neck—each having slightly more than a quarter of the battery market for passenger EVs, according to SNE Research.

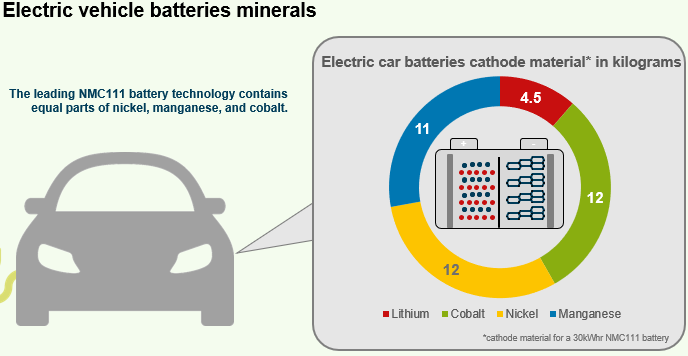

After a decade of price declines driven by economies of scale, new savings may become tougher. Raw materials now account for most of the cost of a battery: Cathode materials such as lithium, nickel and cobalt make up around 30% to 45% of the total, according to S&P Global Platts.

New technologies can help, but securing upstream supply is also becoming more important.

Tesla has inked a nickel-supply deal with Australia’s BHP, the latter said Thursday. Auto makers BMW and General Motors have signed lithium sourcing agreements with miners.

CATL recently took a stake in a copper-cobalt mine. Longer-term supply contracts have also become more common.

This is a Business Wire Feed; edited by Clean-Future Team