Tata Power is in advanced talks with investors such as the Canadian Pension Plan Investment Board (CPPIB), Singaporean sovereign fund Temasek Holdings, and private equity firm General Atlantic to raise up to $600-700 million (Rs 4478 crore – 5225 crore) for its renewable energy business at an equity valuation of $6-7 billion.

The transaction is nearing completion, as the salt-to-steel giant seeks to reduce debt and improve its balance sheet ahead of the alternate energy unit’s scheduled public offering.

Middle Eastern sovereign wealth managers were also approached about a possible purchase. The monetization of renewable energy assets will assist the organisation in meeting long-term goals.

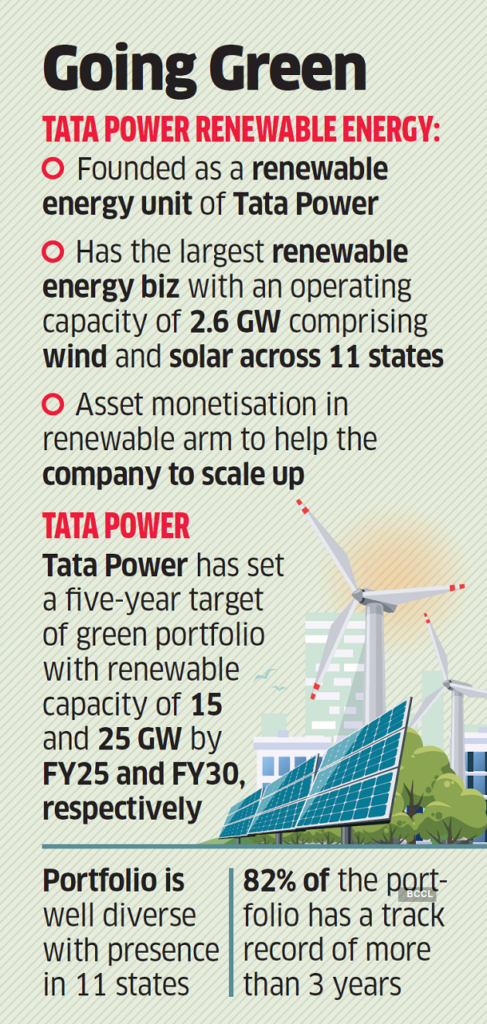

According to rating agency ICRA, Tata Power is one of India’s largest renewable energy companies, with an operating capacity of 2.6 GW comprised of wind and solar in a 32:68 ratio spread across 11 states. The company has set objectives of 15 and 25 GW of renewable capacity by FY25 and FY30, respectively.

It plans to install one lakh EV charging stations, with the goal of more than doubling revenue from the solar EPC business to Rs 10,000 crore by the end of FY 25, up from Rs 4100 crore at the end of FY-21, and increasing revenue from solar pumps (used by farmers for irrigation) to Rs 5000 crore over the next four fiscal years.

At the end of September 2021, the renewable company had a total debt of Rs 11,274 crore. Tata Power Renewable Energy is now one of the top three participants in the renewable energy industry.

Morgan Stanley anticipates Tata Power’s renewable business EBITDA to expand at a CAGR of 12 percent between FY21 and FY25, driven by capacity addition, 1.6 GW under development, and PLF normalisation for its wind assets compared to FY21 levels, while profits will grow at a CAGR of 30 percent.

Reference- Economic Times, Money Control, Mercom India, Business Standard