ArcelorMittal has entered a bidding war with Shell, Adani Group, Singapore’s Sembcorp Energy, and Canadian pension fund CPPIB to purchase Sprng Energy, Actis’ India subsidiary.

This might be the first time in India that a steel company considers such a large green energy purchase.

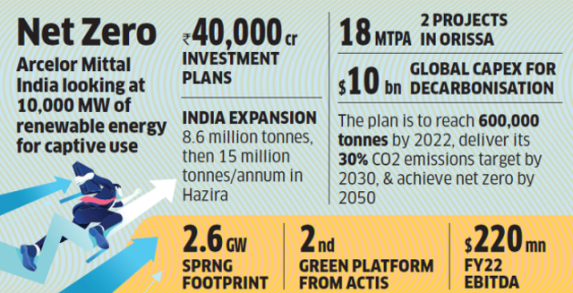

ArcelorMittal, the world’s largest steelmaker, is exploring greener energy options to decarbonize its global and Indian operations. Steel mills are responsible for up to a tenth of worldwide CO2 emissions.

Actis selected Bank of America to commence the sale process for Sprng Energy formally last year.

This was Actis’ second platform, after the $1.5 billion sale of Ostro Energy, the company’s first green energy platform, to ReNew Power Ventures in 2018.

Sprng Energy has signed power purchase agreements (PPAs) totaling 2.6 gigatonnes (GW), with 2.1 GW expected to be operational by March 2022 and another 600 MW expected in March 2023. EBITDA for all contractual assets is expected to be $220 million in FY22.

The business expanded its portfolio in 2019 by purchasing Acme Cleantech’s 600 MW solar energy portfolio in 2021 and the Shapoorji Pallonji Group’s 194 MW solar energy portfolio in 2019.

The purchase is part of a $10 billion worldwide plan for green transformation that began in 2020.

This is a Syndicate News Feed; edited by Clean-Future Team