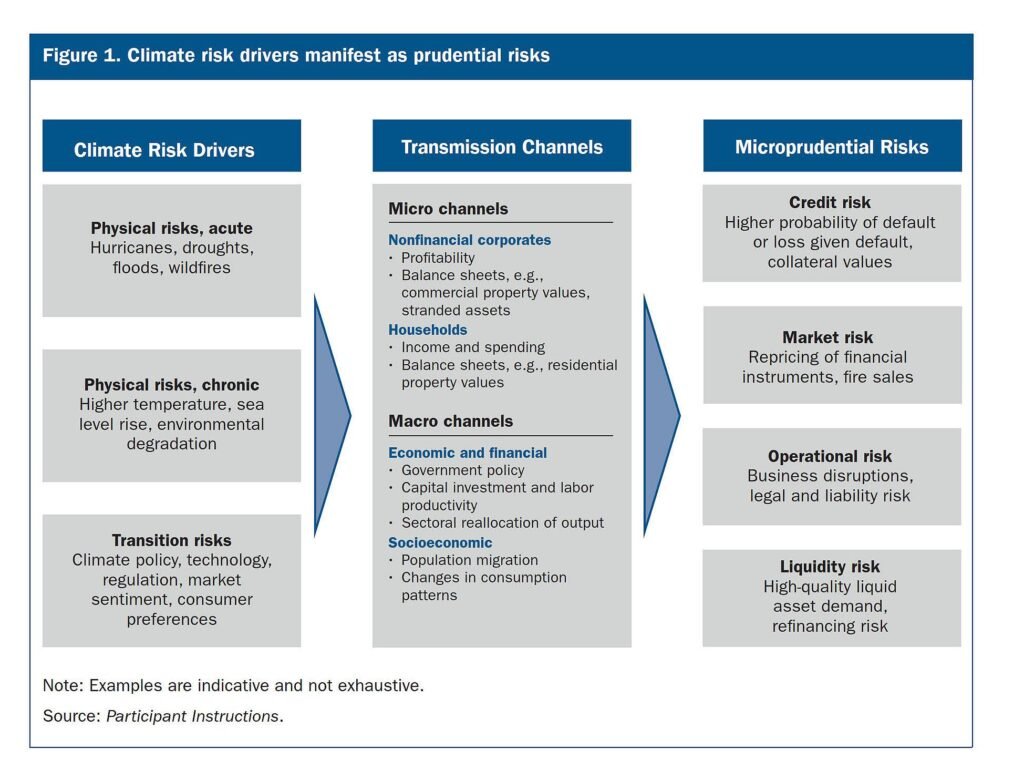

A new study by the Federal Reserve paints a concerning picture: climate change poses a significant threat to the stability of the U.S. financial system. The analysis, based on data from the nation’s six largest investment banks (JPMorgan Chase, Bank of America, Wells Fargo, Goldman Sachs, Morgan Stanley and Citigroup), warns that extreme weather events like hurricanes could trigger widespread loan defaults (failure to repay).

Banks Tested for Climate Resilience

In a first-of-its-kind move, the Fed required major banks to assess their vulnerability to climate change scenarios. This included modeling the potential impacts of extreme weather events, wildfires, floods, and a rapid shift away from fossil fuels. The results, released in a 46-page report, offer a glimpse into the challenges and risks facing Wall Street.

Real Estate Loans at Risk

The study highlights a particularly concerning finding: a severe hurricane in the Northeast U.S. by 2050 could threaten nearly half of the combined residential real estate loan portfolio held by five major banks in the region. This scenario underscores the potential financial devastation extreme weather events can unleash.

Limited Transparency, Big Questions Remain

While the report reveals broad dangers, it lacks detailed information on individual banks’ preparedness for specific climate scenarios. Additionally, crucial data gaps around property insurance coverage and building characteristics hampered the analysis. These limitations leave key questions unanswered about the true extent of the threat.

The Road Ahead: Modeling a Changing Climate

The Fed’s study underscores the critical need for improved data and more sophisticated modeling tools to accurately assess climate risks on the financial system. Banks themselves acknowledged difficulties in the analysis, highlighting the complexity of predicting future natural disasters and the clean energy transition.

Conclusion

Climate change is no longer just an environmental issue – it’s a financial one. The Fed’s study serves as a wake-up call for Wall Street and policymakers alike. As we move forward, robust data collection, enhanced modeling capabilities, and proactive risk management strategies will be crucial to ensure the stability of the financial system in a changing climate.

Reference- E&E News, Federal Reserve (2024, May 9). Results of 2023 Climate Scenario Analysis Exercise PR, Business Insider